With hundreds of trading platforms available all over the internet, choosing the best one might seem like a challenge. In their basic form trading platforms are mediators, enabling traders to buy and sell different assets. Not so long ago, there was not much independence in the area of trading, one would have to call a stockbroker in case of investments. Not only this was a huge process, but the interests were also quite high. As we are progressing all the time in terms of technology, at one point it happened that trading moved online and gave people independence to handle their own trading business, from the comfort of their home.

The concept is quite simple today. All that is required is the account, anyone can open themselves, identity confirmation, deposit and from there you can start trading. Platforms offer complete control over the trade, avoiding the need for a mediator or counselor. They’ve become even more popular and wanted when cryptocurrencies emerged on the market. Since then, everybody wants either to sell or buy. The latest news about the rise in the value of certain crypto coins, along with the financial crisis emerging as a consequence of pandemic, made people invest even more, to secure their future.

So, what are the most important criteria in 2024, based on which the trading platform should be chosen? Here are some tips.

1. Choose the one that supports the most instruments

As we said, there are hundreds available online, however, you should choose the one most suitable for you. You should also not limit yourself to one or two trading instruments, because you never know when the investment opportunity will rise in some other sector. Therefore, as the first step, think about what you wish to invest in. Keep in mind that platforms are meant for those who wish to take part in short-term investments. In other words, if you aim at investing long-term, for example, in some property, then finding a stockbroker to act as a mediator is strongly advised.

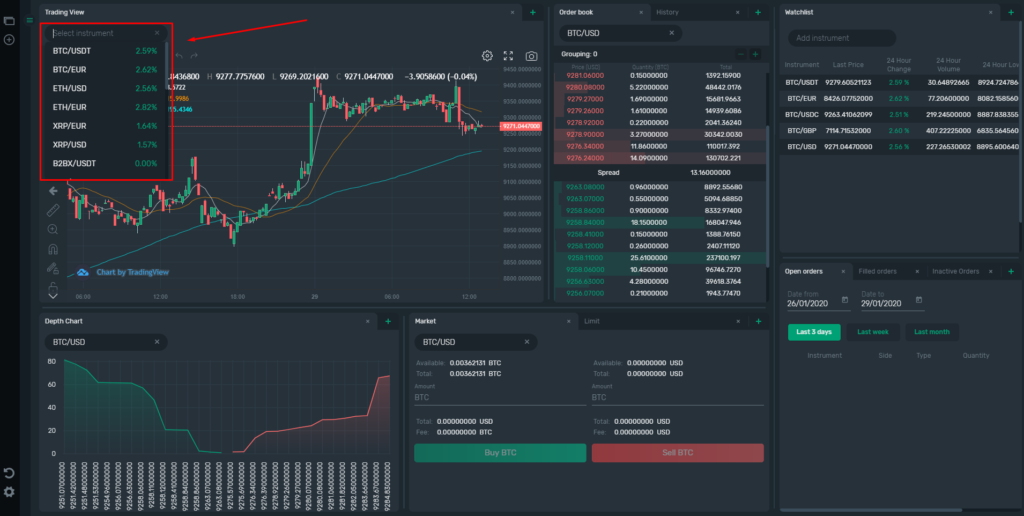

Clickmoneysystem is a good example of a platform that offers multiple investing instruments, giving the fact that it includes crypto, CFD, and other supporting instruments.

Cryptocurrencies are at the moment the most popular investment category, for obvious reasons. CFD follows because it gives you a chance to invest in almost any class of property, without ownership. What you do can be compared to a guessing game, where you guess the real value of the property will rise or drop in the open market.

2. Check if everything is legal

No doubt, this is the most important factor, since we’re talking about money. Make sure you check if the platform has everything sorted out according to regulations. Depending on the location where the platform is registered, it needs to have a license, so check if they have it. One way to check is according to the number pointed out on their website. You’ll probably be able to search further on the internet, to see if it’s not fake. The registries are available online, for most countries, and even if the number is not stated, the search can be performed by name.

No license means it’s not legal, therefore, search for another one.

3. Consider deposits and payments options

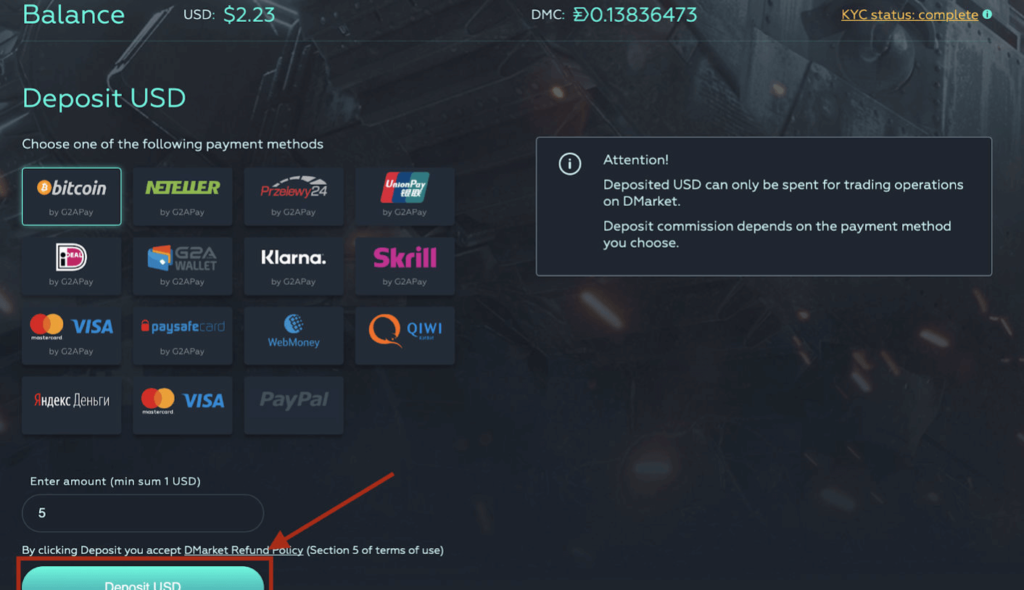

Think about what is the most convenient way for you to deposit and withdraw money from a platform, and according to that, build your criteria for choosing. The majority do have an option for transferring the assets from your bank account to the deposit, however, sometimes this is not the fastest option. Since the prices on the market, especially in the crypto world move drastically from hour to hour (not to mention days), waiting for a couple of days can result in missing the chance for a good investment.

Ideally, what you want from a platform is the deposit to be available the moment you perform a transfer. Therefore, check if the platform supports credit cards, virtual wallets, services like PayPal.

4. Keep in mind the fees

All platforms do what they do in order to make money. Each service given is being charged for, has a fee. The amount of those fees will depend on the type of asset you wish to invest in and trade. For example, Forex is attractive to many because its interest fees depend on how much you trade (it’s calculated based on the amount traded).

When it comes to CFDs, most are offered without fees. However, you should double-check, before opening the account, the limit of spreads.

5. Safety and stability

With the recent rise in the price of crypto, some of the platforms that have had a great image among users were hacked. To everyone’s shock. Many had their deposits wiped out. Therefore, read about other people’s impressions and experiences of certain platforms. Attacks are not easy to predict, but at least you’ll recognize the potential vulnerability some may have.

What you also expect from a good platform is that it works smoothly. If the price alert happens, you don’t want to get stuck in the middle of a transaction, while buying an asset. You’ll be satisfied with those who match the software you use. Check all the details regarding software compatibility to avoid crashes upon updating, as well.

6. Analysis tools should be plenty

If your trading crypto, for example, you need to have a platform suitable for daily trades. Their main characteristic is volatility, therefore daily prices can change a couple of times, drastically. A suitable platform has to have tons of technical indicators, that will show you the pattern of price movements. With their help, you can learn to predict based on the trend history and recognize what influences the rise and fall of the asset price.

Trading software is a great asset for investing since they offer tons of data and possibilities both for daily trading and market analysis. Simply follow the tips we have suggested and you’ll be successful in no time.